How To Find Current Yield Of Bond

Formula to Calculate Bond Equivalent Yield (BEY)

The formula is used in order to summate the bond equivalent yield by ascertaining the difference betwixt the bonds nominal or face value and its purchase price and these results must be divided by its cost and these results must be further multiplied past 365 and then divided by the remaining days left until the maturity appointment.

An investor needs to know the bond equivalent yield formula. It allows the investor to calculate the annual yield of a bail sold at a discount.

Bond Equivalent Yield Formula = (Face value – Purcase Toll) / Purchase Price * 365/d

You are free to use this image on your website, templates etc, Please provide u.s. with an attribution link Commodity Link to be Hyperlinked

For eg:

Source: Bond Equivalent Yield Formula (wallstreetmojo.com)

Here, d = days to maturity

Example

Y'all can download this Bond Equivalent Yield Excel Template here – Bond Equivalent Yield Excel Template

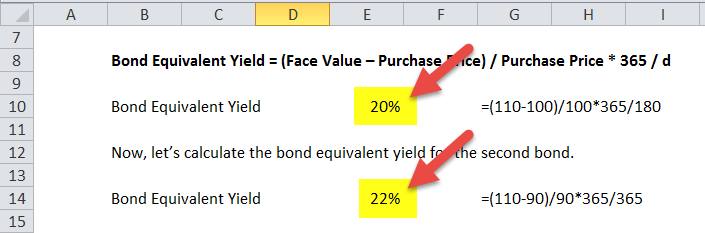

Mr. Yamsi is confused well-nigh two bonds he is considering for investments. One bail is offering $100 per bail equally a purchase cost, and another is offering $90 per bond. For both the fixed-income securities, they would offer $110 per bail afterward half dozen months (for the first) and later on 12 months (for the 2d). Which i should Mr. Yamsi invest in?

This is a archetype case of being confused betwixt two fixed-income securities.

However, we can easily detect out the BEY to see which investment is more fruitful for Mr. Yamsi.

For the first bond, here's the calculation –

Bond Equivalent Yield = (Face Value – Purchase Cost) / Purchase Price * 365 / d

- Or, BEY = ($110 – $100) / $100 * 365 / 180

- Or, BEY = $10 / $100 * 2.03

- Or, BEY = 0.10 * two.03 = xx.iii%.

Now, let'due south calculate the BEY for the second bail.

BEY = (Face Value – Purchase Price) / Purchase Toll * 365 / d

- Or, BEY = ($110 – $90) / $ninety * 365 / 365

- Or, BEY = $twenty / $xc * 1 = 22.22%.

By calculating the BEY for both of these bonds, nosotros tin can easily say that Mr. Yamsi should invest in the second bail.

However, if time becomes a factor, then Mr. Yamsi may choose the first bond considering information technology is six months. It is offering a staggering 20.3% render.

Interpretation

If you lot look closely, yous would meet that there are two parts of this formula for bond equivalent yield.

- The showtime part talks about the confront value, the purchase cost. In short, the first office depicts the return on investment for the investor. For instance, if an investor pays $90 as a buy price for the bond The bond pricing formula calculates the present value of the probable futurity greenbacks flows, which include coupon payments and the par value, which is the redemption amount at maturity. The yield to maturity (YTM) refers to the charge per unit of interest used to discount hereafter cash flows. read more . And at maturity inside 12 months, he would receive $100; the return on investments would be = ($100 – $xc) / $90 = $10 / $90 = 11.eleven%.

- The 2nd part is all about the time horizon. If the maturity for the bond is half dozen months from now, so d would be 180 days. And the second part would outcome in – 365 / 180 = 2.03.

Use and Relevance

Every bit an investor, you take many options. When you accept so many options, yous would merely choose the choice which will provide you with the almost render.

That'southward why y'all need to use the bond equivalent yield formula to find out whether a particular investment is meliorate or worse than the other investments.

Nonetheless, for calculating the bond equivalent yield, you demand to recollect that these investments don't offer annual payments. And you can utilize this formula for fixed income Fixed Income refers to those investments that pay stock-still interests and dividends to the investors until maturity. Government and corporate bonds are examples of fixed income investments. read more securities. For case, if you find out almost a bond and it is offering a discount on the purchase price, showtime exist sure to find out the bond equivalent yield and then get alee (if you lot want to).

Bail Equivalent Yield Estimator

Yous can use the following Bail Equivalent Yield Figurer

| Face Value | |

| Purchase Price | |

| d | |

| Bond Equivalent Yield Formula = | |

| Bail Equivalent Yield Formula = |

| ||||||||||||

|

Bond Equivalent Yield in Excel (with excel template)

Let us now do the same example higher up in Excel. This is very elementary. Y'all need to calculate BEY for both of these bonds.

You can easily summate the BEY in the template provided.

Recommended Articles:

This has been a guide to Bond Equivalent Yield (BEY) Formula. Hither we learn how to calculate bail equivalent yield using its formula along with practical examples and excel templates. You may also learn more about fixed income with these manufactures below –

- Callable Preferred Stock

- Yield in Excel

- Current Yield of a Bond

- Capital Gains Yield Formula

- Treasury Strips

- ix Courses

- 37+ Hours

- Full Lifetime Access

- Document of Completion

LEARN More >>

How To Find Current Yield Of Bond,

Source: https://www.wallstreetmojo.com/bond-equivalent-yield-formula-bey/

Posted by: coatesperis1986.blogspot.com

0 Response to "How To Find Current Yield Of Bond"

Post a Comment